CPA

Certificate Provider :

The American Institute of Certified Public Accountants (AICPA) is the national professional organization of Certified Public Accountants (CPAs) in the United States, with more than 418,000 members in 143 countries in business .

It sets ethical standards for the profession and U.S. auditing standards for audits of private companies, non-profit organizations, federal, state and local governments. It also develops and grades the Uniform CPA Examination.

Program Objective:

Certified Public Accountant (CPA) is a designation given by the American Institute of Certified Public Accountants to those who pass an exam and meet work experience requirements.

Becoming a Certified Public Accountant (CPA) gives an accountant higher standing in the eyes of business contacts, professional peers, regulators, and clients alike.

The AICPA and NASBA The new CPA Exam, called CPA Evolution, introduced a new structure, consisting of three Core exams that all candidates must pass. Each section focuses on knowledge and skills universal to all CPAs:

-Auditing and Attestation (AUD)

-Financial Auditing and Reporting (FAR)

-Taxation and Regulation (REG)

Candidates must also pass one of three Discipline sections. Each one is centered on more specialized knowledge and skills gained in the Core sections:

-Business Analysis and Reporting (BAR)

-Information Systems and Controls (ISC)

-Tax Compliance and Planning (TCP)

This course includes:

400 Hours of Lessons

100 LECTURES

All SKILL levels

Certificate of Completion

Key takeaways from the new CPA Exam blueprint :

Here are the biggest takeaways:

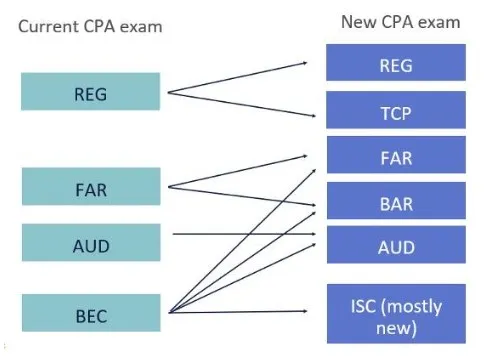

Course Created by

-Most of the content that was previously assessed in the BEC section has been moved to the AUD, FAR, BAR and ISC sections, except the written communication item which will be completely removed.

-The content from the current FAR section will be split between the new FAR and BAR sections.

-Content from the current REG section will be split between the new REG and TCP sections.

-Some content in the current FAR and REG sections will now be tested in the BAR and TCP Discipline sections, respectively.

Below is a diagram to help summarize these changes.

A few important transition items to note:

-If you passed AUD, FAR, and REG prior to January 2024, you will not need to pass the updated versions.

-If you passed BEC before January 2024, you will not need to take a Discipline section of the exam.

-If you fail a discipline section of the exam, you can switch to a different discipline if you find that there is a better option for you.

What You Will Learn

Book 1 : Auditing and Attestation “AUD” :

Engagement Acceptance and Understanding the Assignment

Understanding the Entity and Its Environment (including Internal Control)

Performing Audit Procedures and Evaluating Evidence

Evaluating Audit Findings, Communicatios and Reporting

Accounting and Review Services Engagements

Professional Responsibilities

Book 2 :Financial Accounting and Reporting “FAR”

Conceptual Framework, Standards, Stanard Setting and Presentation of Financial Statements

Financial Statement Accounts

Specific Transactions, Events and Disclosures

Governmental Accounting and Reporting

Not-for-Profit Accounting and Reporting

Book 3 : Regulations “REG”

Ethics, Professional and Legal Responsibilities

Business Law

Federal Tax Process, Procedures, Accounting and Planning

Federal Taxation of Property Transactions

Federal Taxation of Individuals

Federal Taxation of Entities

Course Curriculum

This is exactly what will be covered in this course

-

Professional Standards and Audit Engagements

-

Forming an Audit Opinion

-

Reporting With Different Opinions and Other Auditors

-

Other Information and Supplementary Information

-

Quality Control and Documentation

-

Terms of Engagements and Planning

-

Risk Assessment

-

The Effect of Information Technology on the Audit

-

Identifying , Assessing and Responding to Risk

-

Specific Areas of Engagement Risk

-

Procedures to Obtain Evidence

-

Financial Ratios

-

Sampling

-

Major Transaction Cycles.

-

Misstatement and Internal Control Dificiencies

-

Written Representations and Communication

-

Integrated Audit Procedures

-

Attestation Engagements and Standards

-

Reporting on Control at a Service Organization and Reporting on Compliance

-

Government Audit and Single Audit

-

SSARS Engagements

-

Engagements Process

-

The AICPA Code of Professional Conduct

-

Ethical Requirements

-

Introduction to User Experience Design

-

Introduction to User Experience Design

-

Introduction to User Experience Design

-

Introduction to User Experience Design

-

Introduction to User Experience Design

-

Introduction to User Experience Design

Write a very short description about the lesson here so that your visitors know what they are going to learn in this lesson.

05:00

Write a very short description about the lesson here so that your visitors know what they are going to learn in this lesson.

05:00

Write a very short description about the lesson here so that your visitors know what they are going to learn in this lesson.

05:00

Write a very short description about the lesson here so that your visitors know what they are going to learn in this lesson.

05:00

Write a very short description about the lesson here so that your visitors know what they are going to learn in this lesson.

05:00

Write a very short description about the lesson here so that your visitors know what they are going to learn in this lesson.