CMA

Certified Management Accountant

Looking to boost your career in corporate finance, analysis, or management?

The CMA certification empowers you with advanced skills in budgeting, performance management, and strategic decision-making—recognized by employers worldwide.

Start Your Journey to Excellence

What is the CMA Certification?

The CMA (Certified Management Accountant) certification is a globally recognized professional credential offered by the Institute of Management Accountants (IMA).

It focuses on management accounting and strategic financial management, equipping professionals with the skills to:

-Analyze and interpret financial data.

-Plan and manage budgets.

-Evaluate business performance.

-Support strategic decision-making.

✅ Why Choose CMA?

-

Global Recognition :

The CMA is one of the most respected management accounting certifications, recognized in more than 100 countries. -

Career Advancement :

It opens doors to leadership roles such as Finance Manager, Controller, CFO, or Senior Financial Analyst. -

Higher Earning Potential :

CMA holders earn up to 60% more than non-certified peers, according to IMA surveys. -

Strategic Skillset :

Unlike traditional accounting certifications, the CMA focuses on decision-making, performance management, and strategic financial planning—skills executives value most. -

Flexibility & Opportunity :

With just two exam parts, professionals can complete the CMA in 12–18 months and immediately enhance their career prospects

Course Objectives & What You'll Achieve

By the end of this CMA Part I program, participants will be able to:

Understand and prepare financial statements :

-Present various financial reports

-Apply revenue recognition standards

-Manage receivables, inventory, tangible and intangible -assets, leases, bonds, and taxes

Develop financial planning, forecasting, and budgeting skills :

-Use quantitative forecasting techniques

-Apply strategic planning tools, including SWOT analysis -Prepare operating and financial budgets effectively

Master cost management and operational efficiency :

-Apply key cost accounting methods (absorption, variable, activity-based, life-cycle costing)

-Allocate costs appropriately

-Drive efficiency and minimize waste in business operations

Analyze performance and responsibility accounting:

-Perform variance analysis

-Evaluate performance across business units

-Understand and apply transfer pricing methods

Strengthen risk management and internal controls:

-Implement frameworks such as COSO

-Design effective internal policies and procedures

-Support governance through internal audit and system controls

Leverage accounting information systems and data analytics

-Understand AIS frameworks and applications

-Apply principles of data governance

-Use data analytics and big data to support business decision-making

CMA Part I – Content Outline

-

Section 1: Financial Statements and Financial Reporting

-Presentation of financial statements

-Revenue recognition

-Accounting for receivables and inventory

-Investments & short-term liabilities

-Tangible & intangible assets

-Leases, taxes, and bonds

-Exam practice

-

Section 2: Cost Accounting and Operational Efficiency

-Cost accounting concepts

-Job order & process costing

-ABC & life cycle costing

-Absorption & variable costing

-Cost allocation techniques

-Operational efficiency

-Exam practice

-

Section 3: Forecasting, Planning Techniques & Budget Preparation

-Quantitative analysis & forecasting

-SWOT analysis & strategic planning

-Budgeting concepts & methodologies

-Operational & financial budgets

-Exam practice

-

Section 4: Performance Analysis and Responsibility Accounting

-Cost & variance measures

-Variance analysis applications

-Responsibility accounting

-Transfer pricing

-Exam practice

-

Section 5: Risk Analysis and Internal Control

-Risk and control procedures

-COSO Framework

-Internal auditing

-System controls

-Exam practice

-

Section 6: Information Systems and Data Analytics

-Accounting information systems

-Data governance

-Analytics & Big Data

-Exam practice

View CMA EXAM Fees & Apply Your Discount

Frequently Asked Questions

-

Who should pursue the CMA

Finance professionals, accountants, auditors, analysts, and managers who want to specialize in management accounting and decision-making.

-

What are the requirements to sit for the CMA exam

-Bachelor’s degree (in any field).

-2 years of relevant work experience (can be completed before or after passing the exam).

-Active IMA membership.

-

What is the exam format

Each part has 100 multiple-choice questions + 2 essay scenarios.

-

What is the exam passing score

360 out of 500 (72%).

-

How does the CMA help my career

-Higher salaries (CMA holders earn ~60% more on average).

-Opens doors to managerial and strategic roles.

-Global recognition in accounting and financ

-

In which industries is CMA valuable

CMA is highly demanded in banking, consulting, FMCG, manufacturing, telecom, oil & gas, and multinational corporations.

The Instructors

Course Created by

Mohamed Mostafa

Course Created by

Ahmed Shehata

Course Created by

Mohamed abd el HAMED

Course Created by

EL Desoky Khaled

Course Created by

HANY SALAH

Course Created by

Mohamed Tarek

Course Created by

Mahmoud Mostafa

Course Created by

Mohamed Zakria

Course Created by

Mohamed Ahmed Tony

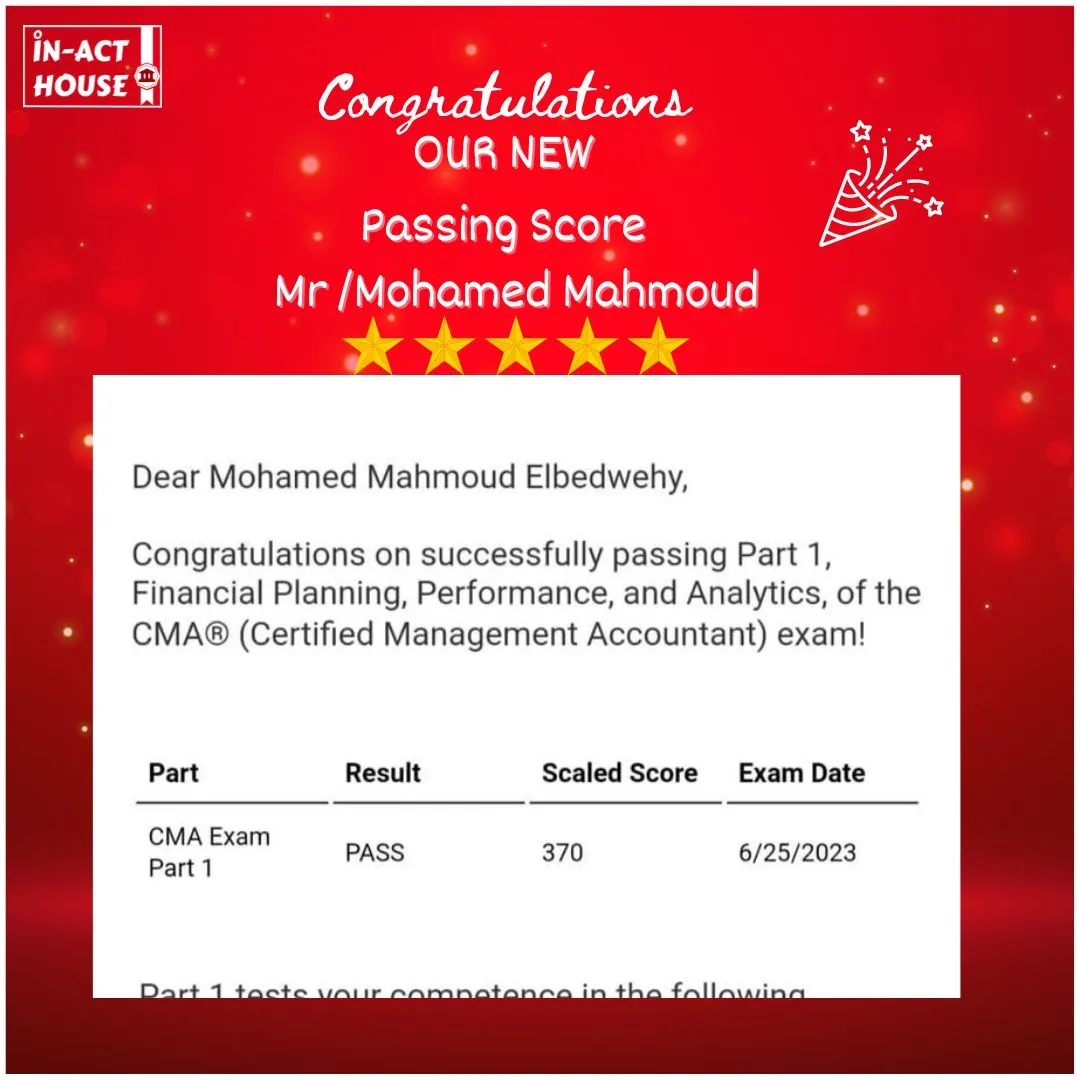

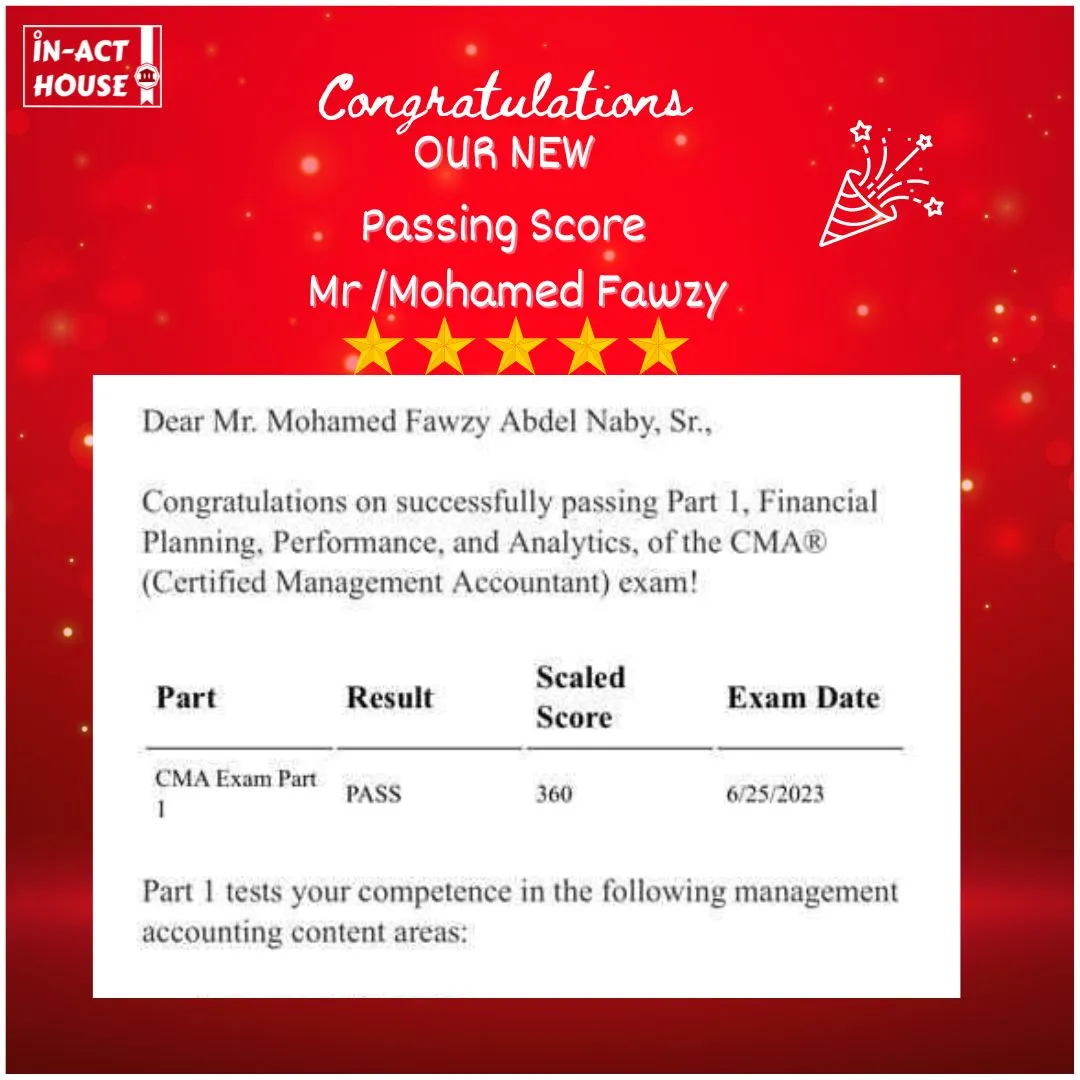

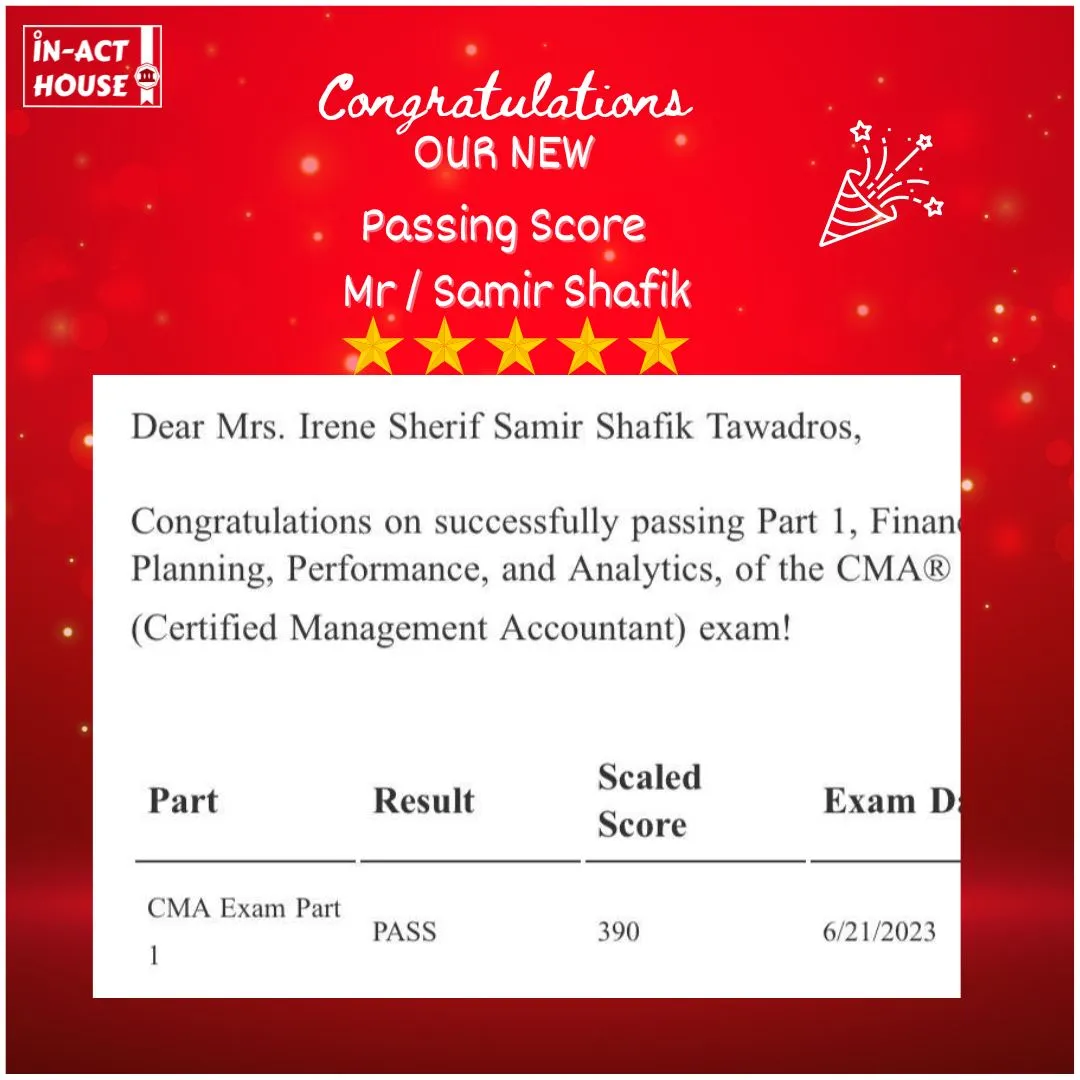

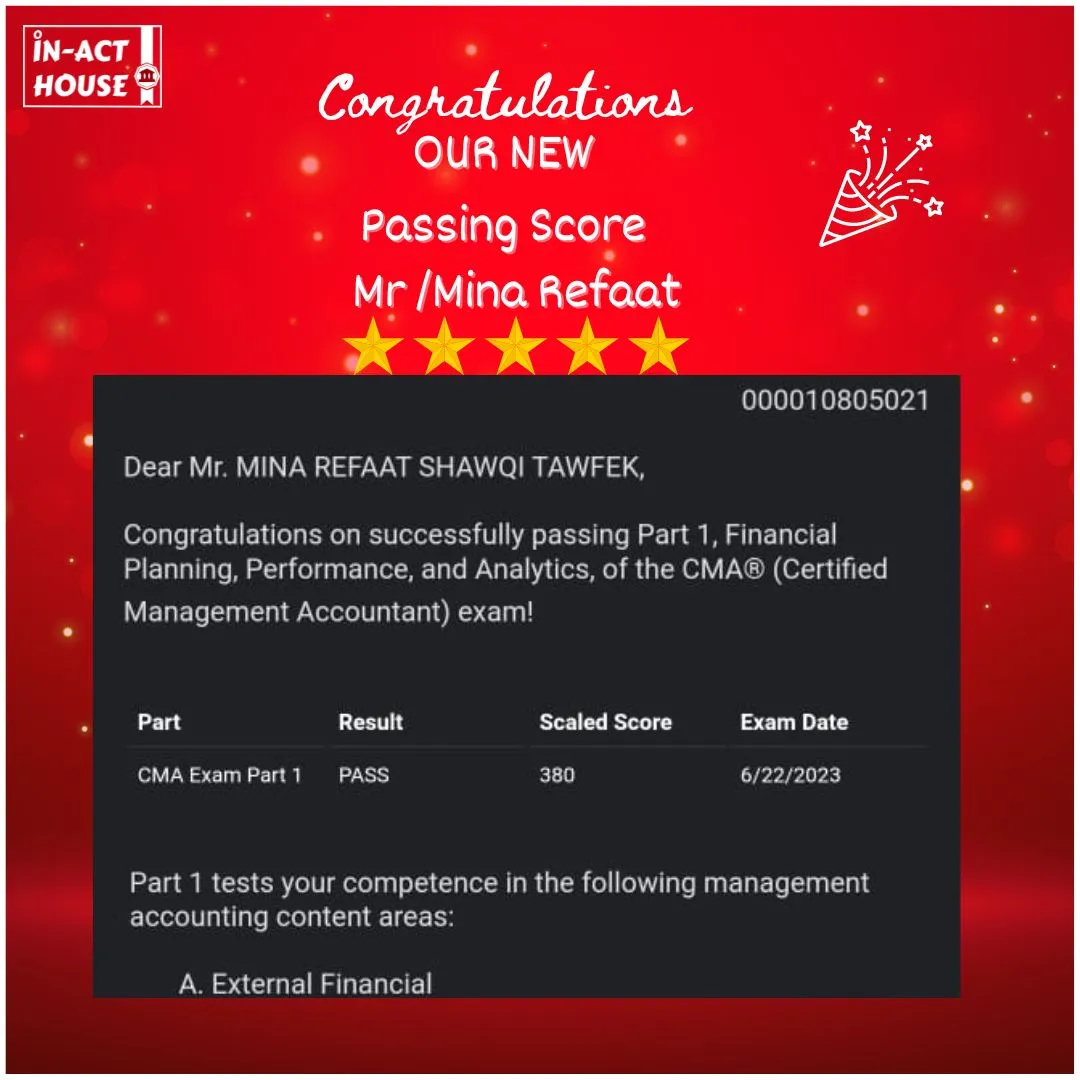

Our Successful students